Our global economy is shifting away from climate risk and toward low-carbon opportunity. This monumental shift towards sustainability and decarbonization is underpinned by pioneering clean and sustainable technology. On the verge of industry transformation, it’s imperative that new climate tech and clean tech are both sustainable and economically viable. The link between climate change and capital markets impacts every facet of businesses and how they operate—so how do we strategically prepare and align with evolving policy and regulations committed to net-zero?

What is a Global Net-Zero Economy?

A global net-zero economy is a visionary concept where the total greenhouse gas emissions produced are balanced by an equivalent amount removed from the atmosphere. Achieving a net-zero state is crucial to limit global warming to 1.5°C above pre-industrial levels, a target set by the Paris Agreement to avert the worst impacts of climate change. To accomplish this, all sectors, from energy and transportation to agriculture and industry, must drastically reduce their emissions and invest in strategies to remove carbon dioxide from the atmosphere. This transition to a net-zero economy involves a complete overhaul of how we produce, consume, and invest in resources, making sustainability and clean technology central pillars of this transformation.

Global Investment

Global investment in clean and sustainable technology has experienced significant growth. According to benchmark reporting and climate-related disclosures, the total investment in clean technology surpassed $600 billion in 2023, indicating a strong commitment from investors worldwide to support climate solutions.

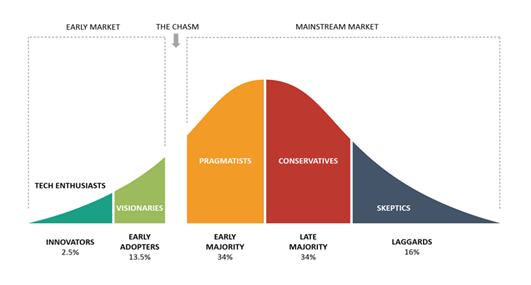

The adoption of clean technology is greatly accelerating toward mainstream adoption and large-scale usage. Software and smart technology eliminate cost and reliability concerns, allowing clean technology to disrupt the market. It’s time for investors to put their money in companies with disruptive innovations, both to accelerate the adoption cycle, but also to maximize their benefit on this substantial market opportunity.

Geoff Moores Chasm Assessment | Forbes 2021

From an investment perspective, Europe and North America are leading the way in supporting clean and sustainable technology. Both regions have robust financial ecosystems that foster innovation and sustainable business models. Government incentives and policies aimed at promoting clean technology have further accelerated investments in these regions.

Net-Zero Commitments from Governing Bodies in North America

To achieve net-zero, governing bodies are employing a combination of regulatory measures, financial incentives, and collaborations with the private sector and civil society. These commitments demonstrate their dedication to combatting climate change and accelerating the transition to a net-zero world. Market trends signal:

- Investment in renewable energy infrastructure

- Promoting energy efficiency

- Increased support for research, development, and innovation

- Encouraging responsible consumption and production patterns.

United States:

The U.S. federal government has made significant strides in its commitment to addressing climate change. The Biden administration rejoined the Paris Agreement, vowing to achieve net-zero greenhouse gas emissions by 2050. To support this goal, they have proposed ambitious climate policies and investments in renewable energy, clean transportation, and climate resilience measures.

- United States Federal Reserve: Beyond governmental bodies, financial institutions are also getting involved. The U.S. Federal Reserve has joined the Network for Greening the Financial System (NGFS), a group of central banks committed to addressing climate-related risks. This involvement signifies a growing recognition of the importance of considering climate-related financial risks in policy decisions.

- Inflation Reduction Act (IRA): Plays a pivotal role in aligning economic stability with sustainability goals. While not directly tied to net-zero emissions, the IRA indirectly supports climate and sustainability targets in several ways. The IRA acknowledges economic stability as crucial for sustainable growth. By controlling inflation, it ensures that financial resources can be directed toward clean tech innovation, renewables, and climate adaptation without destabilizing the economy. It provides a robust economic backdrop for clean tech investments and climate initiatives, contributing to the overarching goal of achieving a net-zero world.

Canada:

The Canadian government has also shown a strong commitment to reaching net-zero emissions by 2050. In April 2021, Canada strengthened its climate target under the Paris Agreement, aiming to reduce emissions by 40-45% below 2005 levels by 2030. They have pledged significant financial support for clean technology and green infrastructure projects, signaling their determination to transition to a low-carbon economy.

- Canada Growth Fund (CGF): Aimed at catalyzing private sector investment in Canadian businesses and projects to drive clean and sustainable economic growth at scale. The CGF, capitalized with $15 billion, seeks to accelerate Canada’s decarbonization strategy and meet its climate targets by investing in projects and companies that reduce emissions, scale up key technologies, create jobs, drive productivity, and capitalize on Canada’s natural resources.

North American States and Provinces:

Sub-national entities in North America are stepping up their commitments as well. Various states and provinces, such as California, New York, and British Columbia, have set their net-zero targets and implemented policies to promote renewable energy adoption, electric vehicles, and sustainable land use.

Investors evaluate clean tech opportunities based on several key factors:

Market Potential: Assess market demand for cleantech solutions, considering factors such as regulatory support, consumer preferences, and industry trends. A growing market with unmet needs presents an attractive investment opportunity.

Technological Innovation: Investors look for companies with innovative and disruptive technologies that have the potential to transform industries. Breakthroughs in energy efficiency, renewable energy generation, and carbon capture are particularly appealing.

Economic Viability: Clean tech investments must make economic sense.

Regulatory Landscape: Favorable policies and regulatory frameworks like the ones mentioned above are favorable including strategic assessment of incentives, subsidies, and penalties related to emissions reduction and sustainability.

Environmental Impact: Environmental, social, and governance (ESG) considerations are increasingly important. Investors assess a company’s sustainability practices, including its carbon footprint, waste reduction efforts, and overall commitment to responsible business practices.

Scalability and Growth Potential: Clean tech investments are often evaluated based on their scalability and growth potential. Companies with the ability to expand operations and capture larger market shares are more attractive to investors.

Risk Management: Investors also analyze the risks associated with clean tech investments, including technological risks, regulatory changes, and market competition. Diversification strategies may be employed to mitigate these risks.

The Construction Industry’s Role in Achieving Global Emission Reduction Targets:

The construction industry plays a pivotal role in achieving global emission reduction targets. With the industry accounting for 40% of worldwide energy usage, its impact is twofold: it directly contributes to emissions through construction activities and indirectly influences emissions through the energy efficiency and sustainability of the buildings it creates. To fulfill its responsibility, the construction industry must adopt a multifaceted approach:

Sustainable Design: Architects and engineers must prioritize sustainable building design, integrating energy-efficient systems, high-performance building materials, and passive design principles to reduce a building’s carbon footprint.

Green Materials: The use of green materials, such as recycled steel, low-carbon concrete, and energy-efficient insulation, should become standard practice, reducing the embodied carbon in construction projects.

Energy-Efficient Practices: Construction practices should incorporate energy-efficient technologies, such as smart building systems and LED lighting, to reduce energy consumption in buildings.

Lifecycle Analysis: The industry should embrace lifecycle analysis, considering the environmental impact of a building from construction through occupancy and eventual demolition to accurately assess both the operation and embodied carbon footprint.

Final Word:

The imperative to address climate change and align with evolving policies and regulations for a net-zero future is clear. Pioneering clean and sustainable technology is at the forefront of this transformation. As we move towards a global net-zero economy, clean technology innovation exemplifies the potential for businesses to thrive while prioritizing sustainability.

The injection of significant venture funding into clean technology reflects a broader acknowledgment of the urgent need to combat climate change and reduce our carbon footprint. It also signals a profound shift in the construction industry, as investors recognize the potential for sustainable materials to drive profitability while protecting the planet. The construction industry’s role in achieving global emission reduction targets cannot be overstated, making it a linchpin in the journey towards a cleaner and more sustainable future for all.

By embracing these economic strategies, the construction industry can make significant strides in reducing its carbon emissions and contribute to the broader global efforts to achieve a net-zero future. Policymakers, businesses, and consumers all play a role in supporting and demanding sustainable practices within the industry.

To stay updated on ZS2 Technologies’ journey and breakthroughs, subscribe our newsletter and follow our social media channels.

Together, let’s build a better planet now, not tomorrow.